Market Overview - Looking forward to a healthy year?

As the Laing and Buisson annual health report is published, Stephanie Denton talks to its author, Philip Blackburn, about the changes the healthcare market has seen over the past 12 months

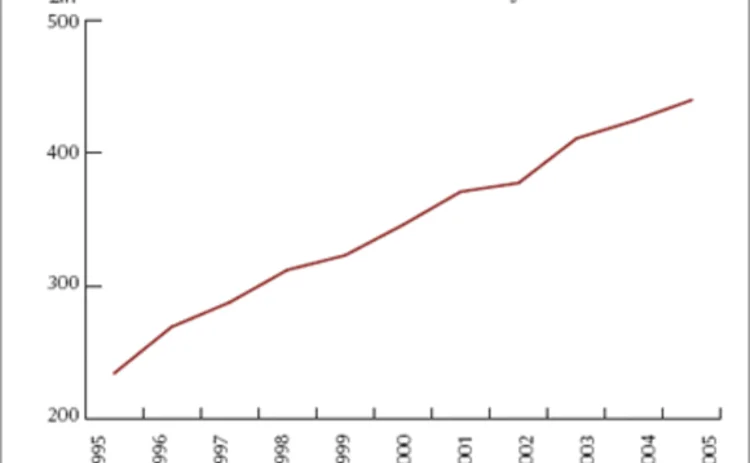

Spending on health and care cover products in the UK, including private medical insurance, health cash plans, dental benefit plans and long-term care insurance, has grown by £200m in the last year and

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Most read

- Civil injury fraudster caught out by ‘Jeremy Kyle’ appearance

- Covéa shrinks staff numbers by almost a third amid further losses

- DLG or Esure – which Peter Wood baby is most likely to bounce back?