News

Hurricane season leaves companies facing rating pressures

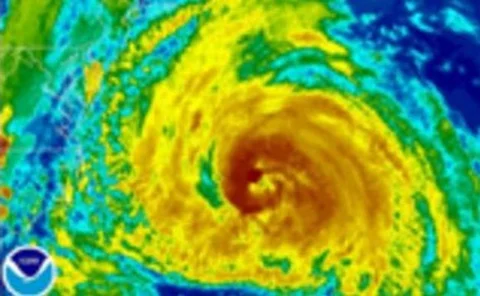

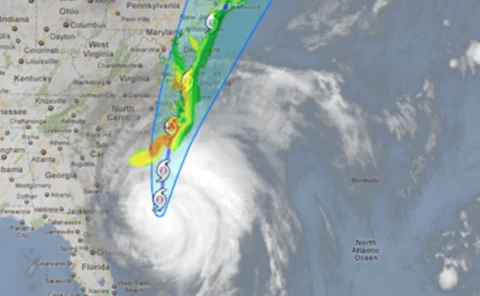

Insurance companies could be left facing rating pressures as the potential for continued hurricane-related activity increases throughout the peak season, according to experts at A.M. Best Co.

Governments leveraging private insurance skills

More governments are leveraging private insurance skills and the growing capacity of the sector to cover catastrophe losses as well as a wide range of other risks, according to Swiss Re in its latest sigma research publication.

Essex broker rebuffed by Qmetric over Primo name - Insurance News Now

Post senior reporter Amy Ellis outlines this week's major general insurance stories which include an Essex based insurance broker lodging a formal complaint against Qmetric for using the Primo trading title which it claims was its brand name first.

Hurricane season leaves companies facing rating pressures

Insurance companies could be left facing rating pressures as the potential for continued hurricane-related activity increases throughout the peak season, according to experts at A.M. Best Co.

Insured losses from Irene could reach $3.4bn

Risk modelling firm Eqecat has estimated that hurricane Irene could cost insurers between $1.8bn and $3.4bn.

All conditions satisfied for Giles' CBG bid

All conditions for the £5.1m offer from Giles for fellow broker CBG have now been satisfied.

Columbus Direct to offer ash cloud cover

Columbus Direct has launched a new ash cloud travel cover designed to protect customers in the event their travel plans are disrupted by a volcanic eruption.

Keelan Westall and CKW renegotiate claims deal

Property insurance brokers Cadogan Keelan Westall and Keelan Westall have renegotiated their delegated authority agreement with insurer Zurich to allow the in-house claims team to process and settle claims up to £5000 net of policy excess.

Omega points to H1 catastrophes following early losses

Record industry-wide catastrophe losses have been blamed by Lloyd’s insurer Omega for an after-tax loss of $44.5m (£27.2m) in the first half of 2011.

Howden opens for business in Bermuda

Howden Broking Group, part of international insurance and reinsurance distribution group Hyperion, has opened a new wholesale and retail operation in Bermuda’s capital, Hamilton.

Foil warns MP on civil justice reform

City insurance lawyers group the Forum of Insurance Lawyers has warned MPs planning to reform civil litigation costs not to “go soft” and be swayed by those arguing against change.

Audience with Zurich: Techmedia sector in the spotlight

Zurich Insurance today launched independent research which found that more than half of Britain’s mid-size technology companies feel at risk from losing skilled employees, with the figure rising to 70% amongst companies with a £25-£100m annual turnover.

16 firms paid 92% of PPI compensation

The Financial Services Authority has said that 16 firms, representing 92% of all payment protection insurance complaints received in the first half of 2011, have paid a total of £215m in redress between January and June 2011.

L&G puts Holweger in charge of brokers

Legal & General’s general insurance business has appointed Coverwise founder Mark Holweger to the new role of broker & intermediary director.

Guernsey comes top in domicile poll

Guernsey's position as one of the leading captive insurance domiciles globally has been reinforced by the results of a new study into the sector.

No major Caribbean losses from Irene

The Caribbean Catastrophe Risk Insurance Facility has announced that, while Hurricane Irene resulted in registered losses in six of its member countries (Anguilla, Antigua & Barbuda, the Bahamas, Haiti, St. Kitts & Nevis and the Turks & Caicos Islands),…

Solvency II could contract personal lines insurance market

Nine out of ten senior financial services executives expect the costs of complying with Solvency II to force smaller firms to quit personal lines insurance unable to make a profit, reducing choice for consumers.

Swiss Re warns of challenging market for Nordic insurers

In Oslo today, Swiss Re, will use its flagship Nordic Risk & Insurance Summit conference to warn that the economic environment in the wake of the financial crisis is still very challenging and turbulent.

Birmingham tops crash-for-cash league

For the sixth consecutive quarter Birmingham has been named the number one hotspot for crash for cash insurance Fraud by the Insurance Fraud Bureau.

Hurricane Irene could cost insurers as much as $6bn

Catastrophe modeling firm Air Worldwide estimates insured losses from Hurricane Irene to onshore properties in the US will be between $3bn and $6bn.

Travelers shakes up its Lloyd's team

Travelers has announced a series of promotions within its Lloyd’s operation Travelers Syndicate Management.

US reinsurers hit by claims

The Reinsurance Association of America says its group of 19 US property and casualty reinsurers wrote $13.8bn of net premiums during the six months ended June 30, 2011, an increase from the $12.3bn written in the first six months of 2010

Irene to cost insurers as much as $6bn

Catastrophe modelling firm AIR Worldwide estimates that insured losses from Hurricane Irene to onshore properties in the US will be between $3bn and $6bn.

'Merlin Academy' graduates primed team leader roles

Graduates from the first class ever to undertake the ‘Merlin Academy’ accredited Chartered Management Institute Level 2 Certificate in Team Leading have praised the content of the course.