News

ING to axe 1350 insurance staff

Dutch finance giant ING is to cut 2350 jobs, over half of which will come from insurance operations.

Myanmar corruption could be obstacle for insurers

Corruption is one of the many stumbling blocks facing insurers entering Myanmar's fledgling insurance market, industry insiders have told Reuters.

Apil president calls for insurers to back his anti-fraud plan

Association of Personal Injury Lawyers president Karl Tonks has challenged the insurance industry to work with Apil to tackle "genuine fraudsters", following the publication of the association's annual report on whiplash.

Allianz CEO urges insurers to embrace Russian market

The rapid development of compulsory insurance in Russia provides a huge opportunity for foreign insurers, according to Hakan Danielsson, chief executive of IC Allianz Russia.

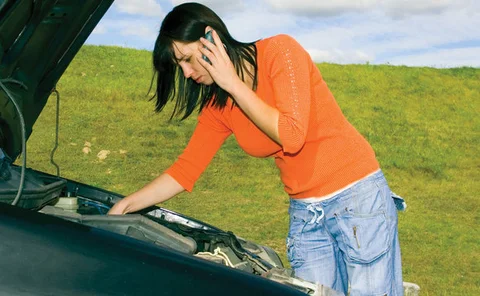

First Central unveils motor breakdown product

First Central has launched a new breakdown cover product to help motorists with day-to-day problems.

State run Indian GI insurers seek common TPA arrangement for health

State-run Indian general insurance companies are setting up a common third-party administrator to settle medical insurance claims, to trim unwieldy claims ratios and boost profitability.

Fire losses make up 50% of Indian GI claims

Fire losses accounted for over half of the claims lodged with Indian general insurance companies in 2011-12.

GAB Robins reports profit rise in 2011

GAB Robins' pre-tax profit increased to £2.14m for the full year 2011, from £1.56m in 2010.

Jubilee parent completes Direct Group deal

Ryan Specialty Group is completing the acquisition of Direct Group today.

RSA hails "unique geographic footprint" after 15% growth in emerging markets

Emerging markets led growth for RSA in the first three quarters of 2012 as challenging conditions continued to affect performance in its core European market.

Towergate dismisses Paymentshield speculation

Towergate has denied speculation that the firm is planning to sell its mortgage payment and insurance business Paymentshield.

Chubb HNW offering receives facelift

Chubb is revamping its high net worth underwriting and account handling teams in a bid to make its offering more relevant to brokers.

Benign nat cats help Swiss Re to $2.2bn net income in Q3

Swiss Re reported net income of $2.2bn in the third quarter of 2012, driven by strong performance from P&C reinsurance and a one-off gain from the sale of the Admin Re US business.

Swiss Re sees Q3 profits soar

Reinsurance giant Swiss Re has reported an improvement of just over 60% in group profits for the third quarter.

Two aviation underwriters join Antares

Lloyd's insurer Antares has appointed Simon Hennessy and Russell Mason as aviation underwriters.

Bluefin white-labels Lorega 10

Independent broker Bluefin is to white-label loss recovery insurance product Lorega 10, branding it as Bluefin Response.

Xchanging secures Lloyd's claims reporting contract

Business technology services provider Xchanging has landed a contract to build a platform for the Lloyd's claims reporting suite.

Novae insurance income to dwarf reinsurance earnings

Novae Group's investment returns grew by £6.5m to £22.1m for the first nine months of 2012, but gross written premiums remained flat at £510.6m (2011: £516.4m).

ProSight names Towers Watson director as syndicate CRO

ProSight has appointed Ryan Warren as chief risk officer for its Lloyd's Syndicate 1110.

Aspen launches professional indemnity products

Aspen Risk Management has created a range of professional indemnity products to provide greater flexibility and choice.

Chartis appoints regional head

Chartis has appointed a new regional manager for the Midlands and south west.

RSA 'well positioned' for economic woes, analysts say

Analysts have responded positively to RSA's results for the nine months to 30 September 2012, but warned that a series of storms like Sandy could affect its "attractive" dividend yield.

Ace highlights environmental issues as top European emerging risks

A survey of 600 risk managers, chief risk officers, chief financial officers, chief operating officers and insurance buyers found that 35% of mid-size companies view environment risk as the top emerging concern.

RSA UK premiums flat as international business grows

RSA is on target to deliver a combined operating ratio of around 96% and £500m investment income for the 2012 full year after reporting a 4% jump in net written premiums to £6.2bn for the nine months to 30 September 2012.