News

BIS 2010: Rates to harden under SII

The implementation of Solvency II could lead to the return of a hard market, according to John Neal, chief underwriting officer, QBE European Operations.

BIS 2010: Making the most of multi-channel distribution

The LV brand will not cross over into the fledgling direct insurance SME space, according to LV Broker managing director Phil Bunker.

BIS 2010: Quality people needed to drive innovation

Steve Lewis, UK chief executive general insurance at Zurich, said the insurance industry needs to sell itself better and attract quality individuals in order to be innovative.

BIS 2010: RBS staff crucial to recovery

Royal Bank of Scotland has hailed its new approach to staffing as a key factor in its continuing recovery.

BIS 2010: Insurance must shake off “grey and old” tag

The insurance industry must overcome perceptions of being “boring, difficult to deal with and overly complex” in order to attract a new generation of talent, according to CII president Chris Hanks.

Monte Carlo preview - Destination: Monaco

Reinsurers viewing customers as commodities - Barbican.

BIS 2010: SME insurers will "struggle" under Solvency II

Large diverse European insurers such as Generali, Axa, and Allianz should be the "big winners" under Solvency II, an ABI director has predicted.

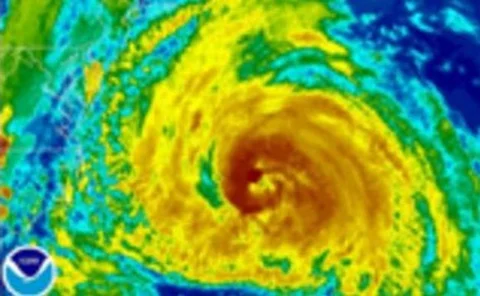

News analysis: H1 reinsurer results slump

Bermudan reinsurers recorded huge drops in profits following heavy claims from the catastrophes experienced in the first half of the year, though elsewhere some reinsurers fared better, writes Katherine Blackler.

Aon's contingent commissions alarming for industry - Willis

Willis has claimed that Aon's announcement of its resumption of accepting contingent commissions "where appropriate and legally permissible" is a wake-up call to insurance buyers.

GC files against Lockton Re

Guy Carpenter has filed a suit in a bid to recoup brokerage fees after clients followed an employee to Lockton Re. The action follows disputed brokerage fees for placing reinsurance coverage.

BIS 2010: Actuaries can "charge what they want"

The Actuarial profession is undergoing a "Y2K moment" as the demand for skills increase under looming regulatory proposals, WNS Global has said.

Neal Bill opposition grows

Opposition to the bill proposed in the US congress by senator Richard Neal has continued to grow this month, with the CEA and German government both voicing opposition.

Aon Benfield ILS benchmarker

Aon Benfield Securities has launched an insurance-linked securities (ILS) benchmarking tool, Aon Benfield ILS Indices, which provides a quantitative view of ILS returns since December 2000.

Ironshore enters space market

Ironshore's aviation division has entered into a treaty reinsurance programme with the Starr Group to provide protection against commercial satellite risks. The global space insurance programme provides coverage for satellite launch insurance and in…

Scor reports 19% growth

Property and casualty and specialty treaty renewals at end of June have resulted in premium growth of 19% at constant exchange rates, while fully respecting the technical underwriting profitability criteria.

Brit opens books to private equity

Brit has confirmed that private equity house Apollo has submitted a revised indicative proposal to acquire the entire issued and to-be-issued ordinary share capital of the company at a price of £10.75 for each share in cash.

Goss Re appoints new CEO

Goss Reinsurance Brokers, the reinsurance brokerage division of US Risk Insurance Group, has appointed Scott Brock as chief executive officer.

Carroll joins Chaucer board

Chaucer Holdings has appointed Tim Carroll, former underwriting director at managing general agents Canopius, as a non-executive director at Chaucer Syndicates, its managing agency and main operating company. He has also joined the risk and capital…

Asia push sees Howden extend into Singapore

Howden Broking Group is set to expand its Asian wholesale operation after securing a trading licence in Singapore and rebranding its Korean joint venture under its own name.

Ex-Fortis fraud boss joins Groupama

Andy Pagett has been appointed by Groupama Insurances in the senior role of counter fraud manager.

Q2 cat bond issuance surge

Guy Carpenter has announced the completion of eight catastrophe bond transactions, totaling $2.05bn of risk capital as investor appetite remains strong.

Energy rates rise

Worldwide energy insurance rates will continue to harden in 2010 because of the Deepwater Horizon oil disaster Beazley has claimed.

Gallagher acquires SBA

Gallagher International has acquired Australia-based natural resources risk management provider Specialised Broking Associates for an undisclosed sum.

BIS 2010: CEBR warns of “sluggish” insurance market

The economic landscape following the credit crunch will cause growth in the European insurance market to slow, the Centre for Economics and Business Research has claimed.