ESG Blog: How should insurers decarbonise their portfolios in 2022?

Christophe Herpet, deputy head of fixed income, and Laurent Clavel, head of Axa IM Quant Lab, Axa Investment Managers, mull over what insurers should expect as they decarbonise their portfolios, and how best to manage the risk factors such as climate change and economic transitions

The process of decarbonising portfolios remains more of an art than a science. It is a discipline where the quantitative and the qualitative must sit side by side, and where the nature and quality of inputs may rapidly evolve.

That makes it no simple task for an insurer to address climate in portfolios, but it is a journey that must begin now. Institutional investors need their asset managers to be at the leading edge of the science and research that defines the global response to climate change, and the emerging possibilities in asset allocation.

Era-defining challenge

Climate change is an era-defining challenge for the world, but in investment terms it is no different from any other key risk. It is an asset managers’ fiduciary duty to ensure they are mitigating against the impact of climate change – whether this comes from physical risks such as flooding, drought, biodiversity loss or the displacement of communities, or from transition risks as the market moves ever closer to full carbon pricing and creates corporate winners and losers in the race to net zero.

For insurers’ fixed income assets, both risks raise the prospect of credit impairment, unevenly spread across markets and issuers. At a portfolio level, it is the transition risk that should attract the most attention at this stage – and this can present some compelling opportunities.

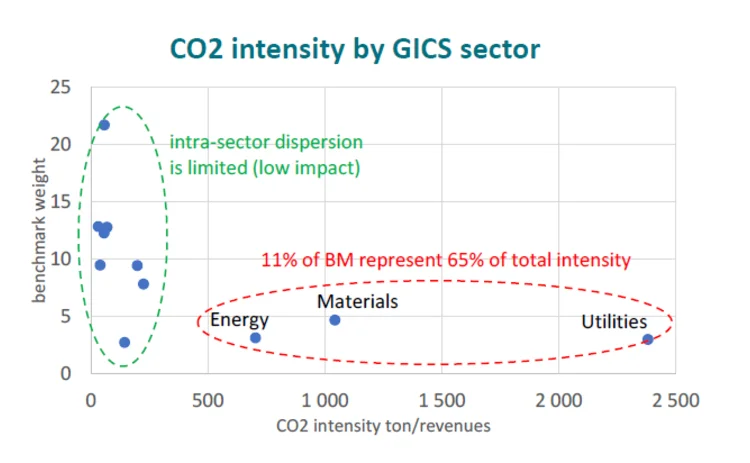

From a quantitative point of view, while it is becoming far easier to attach a temperature to a portfolio, there is no universally accepted method for capturing this, and certainly for predicting it into the future. In the drive towards harmonisation of this process, the focus must be on carbon intensity – a measure of greenhouse gas emissions relative to revenues. And that means focusing on three sectors: energy, materials and utilities, as shown in the chart.

Source: Axa IM

On the path to decarbonisation, investors may be tempted to simply remove those companies in the red circle. But this action will very quickly run into difficulty. Not only does it sharply diminish the possibilities for diversification; it also contains a logical flaw. Those companies sitting in the green circle do not operate on thin air. They provide the demand for energy and raw materials, whether that is to make and sell products or run offices that deliver services.

Focus

The focus must be to shift the high-emitting companies decisively down the scale of carbon intensity to create a portfolio that supports a genuine transition rather than just pulling shut the curtains on the difficult part of the job. In order to do this, analysis of best-in-class companies is crucial. Investors need granular analysis of the nature and scale of those high-emitting businesses to understand which ones are making real progress on delivering climate change solutions.

The focus must be to shift the high-emitting companies decisively down the scale of carbon intensity to create a portfolio that supports a genuine transition rather than just pulling shut the curtains on the difficult part of the job. In order to do this, analysis of best-in-class companies is crucial.

An oil firm with a large distribution business might register better raw emissions data than a peer that is focused on production, but the rival might have a far more advanced transition pathway. Ultimately, someone has to generate the power. This might make the process of portfolio decarbonisation appear deeply complex, but a tightly focused approach can make this an easier journey for insurance schemes.

From a fixed income perspective the aim should be to achieve decarbonisation by delivering a highly selective portfolio that steadily and spontaneously reduces its carbon intensity over time, potentially without further intervention.

However, there are some nuances within this that must be taken into account, particularly in regards to buy-and-maintain credit strategies – a traditional holding for many insurance schemes. The integration of climate into B&M credit strategies adheres to three central ambitions: capital preservation, climate alignment and credit return. The goal should be to avoid defaults and impairments, align with net zero by 2050 and maximise the premium over government bonds.

To achieve this, insurers should visualise their credit portfolios as split into three buckets – short, medium and long-term. The short-term bucket should contain tactical allocations around those issuers identified as transition leaders. By holding these issuers over the shorter-term, it allows investors to review and re-test transition pathways of issuers as bonds mature.

The next step would be combining a medium-to-long-term strategic positioning around climate leaders, green bonds and climate solutions providers. As well as providing the full opportunity to maximise cashflow and spreads, the longer-term buckets would allow insurers to match assets to their duration needs. This approach acknowledges that climate-aware portfolios will need the flexibility to realign themselves as net zero approaches and that decarbonisation journeys will take time.

By being a bit more patient, and employing a more dynamic approach to portfolio construction, insurers can seek to address these challenges, decarbonise in a more thoughtful and effective way and achieve their longer-term climate objectives.

Post’s ESG Exchange

This article is part of Post’s ESG Exchange from 7 to 18 March featuring free to access webinars, blogs and interviews focusing on ESG.

Today ESG is a powerful tool in the insurance industry, presenting both risks and opportunities for businesses. Register now to watch any of the ESG focused webinars, and have the opportunity to explore and read future content online.

- What do SMART environmental goals look like for the insurance industry?

- Implementing ESG practices across the insurance supply chain.

- What are some of the challenges in creating a more diverse workforce?

- Which area of business should you focus on first in implementing the ESG Agenda

- Will ESG reputation end up being one of the top attractions for insurers in terms of investments?

To register, please click here

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk