Claims

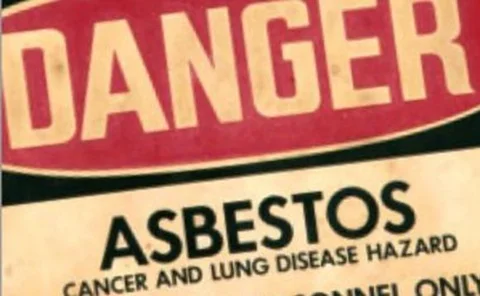

European insurers with US APH liabilities face solvency scrutiny

European insurers that hold US Asbestos Pollution and Health Hazard liabilities will be subject to greater scrutiny of their financial accounting according to new research.

Ecclesiastical adopts new subsidence risk model

Ecclesiastical Insurance Group has licensed a new computer model from technology provider Business Insight that predicts the risk of subsidence claims being incurred across the UK.

Axis promote cat claims manager for the Caribbean

Loss adjuster Axis has promoted a new regional manager to take over responsibility for the delivery of adjusting catastrophe claims in the Caribbean.

September 11 attacks have made insurers more resilient to ‘unthinkable' events

This is one of the findings of the latest report into the event by International insurance think tank, The Geneva Association.

Geneva Association reports on 9/11

International insurance think tank, The Geneva Association, has said the impact of the September 11 2001, attacks on the insurance industry was much smaller than expected at the time.

ABI calls for an end to the “have a go” compensation culture

Leading retailers and business groups join forces with the Association of British Insurers in calling for an end to the “have a go” compensation culture.

Cunningham get travel claims fraud role

Cunningham Lindsey has secured the contract to become the sole supplier in respect of travel claims fraud investigations for Ageas Insurance.

Insurance Insight September: Renewable energy, mobile technology and THB

Insurance Insight September is now live with an article on insurers’ growing interest in renewable energy; a look at the new demand for mobile insurance; and an interview with broker THB to find out about its latest expansion plans.

Insurance Insight Q&A: Paul Lindeboom

Broker THB recently made the news with its expansion plans for its Amsterdam office. Insurance Insight caught up with Paul Lindeboom, executive director of THB’s Amsterdam operation, to find out all the news on the new appointments and what the plans are…

Embracing the mobile technology boom

Recent research suggests that with consumer demand for mobile devices on the increase insurance cover is set to grow. Jakki May reports on whether insurers are taking full advantage of this in emerging Europe.

Aspen pulls out of solicitors' PI

Aspen Risk Management will not write any more solicitors’ professional indemnity for the "foreseeable future".

Spanish funeral insurer Ocaso receives A+ rating

Spanish insurer Ocaso, S.A. Seguros y Reaseguros has had its financial strength rating affirmed as A+ (Superior) and the issuer credit rating of “aa-” by ratings agent AM Best. The outlook for both ratings is stable.

Prima completes €1.4m funding

Prima Solutions, software provider for life, P&C, large commercial risks and reinsurance Software, has completed a €1.4m round of funding.

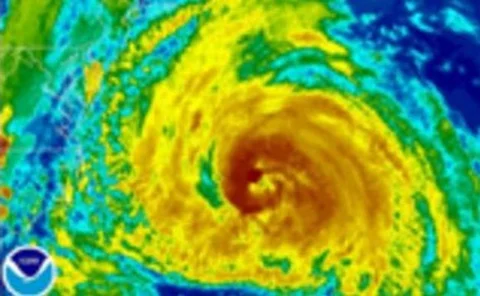

Hurricane Katia may threaten US

Hurricane Katia, was today given ‘hurricane status’, but it is too early to tell whether will threaten communities in the Caribbean, Bermuda or in the US, according to early reports from Risk Management Solutions.

Insured losses for Hurricane Irene "manageable" $6bn

The insured loss estimate for Hurricane Irene is said to be between $3bn to $6bn making the impact on insurers “material” but “manageable”, according to Fitch Credit Ratings.

The compensation culture is a myth

I would like to pick up on a section of the article ‘Two sides to the story’ in which it is mentioned that ‘the compensation culture has become firmly embedded in the UK’ and ‘a system less clogged up by frivolous claims will mean swifter access to…

Clinicians call for a whiplash consensus

Leading clinicians are set to call for a new consensus in tackling the whiplash culture in the UK at a conference in November.

Business interruption - recessionary impact: Predicting the unpredictable

An uncertain economic climate is making the quantification of business interruption claims even more problematic. Tony Levitt explains.

Fraud - pet insurance: Vetting animal claims

Animal-related fraud is on the increase, with exaggerated claims for treatment a common cause. Claire Laver and Carys Clarke examine ways to combat the problem.

Lawyers target insurers through fraudulent claims

Solicitors practice Cost Advocates has warned of a growing trend of claimant lawyers submitting costs for personal injury claims.

Post Magazine - 1 September 2011

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

Insured losses from Irene could reach $3.4bn

Risk modelling firm Eqecat has estimated that hurricane Irene could cost insurers between $1.8bn and $3.4bn.

Essex broker rebuffed by Qmetric over Primo name - Insurance News Now

Post senior reporter Amy Ellis outlines this week's major general insurance stories which include an Essex based insurance broker lodging a formal complaint against Qmetric for using the Primo trading title which it claims was its brand name first.

Columbus Direct to offer ash cloud cover

Columbus Direct has launched a new ash cloud travel cover designed to protect customers in the event their travel plans are disrupted by a volcanic eruption.