Claims

ABI and Accident Exchange boss clash over 'scapegoating' of credit hirers

The director of general insurance at the Association of British Insurers and the chief executive of credit hirer Accident Exchange have exchanged heated emails after the ABI welcomed the Office of Fair Trading's decision to provisionally refer the motor…

ISA 2012: Insurers urged to sharpen up claims management processes

Rising claims recorded in Asia due to the Thailand floods and Japan earthquakes mean that optimising claims management is critical for insurers seeking to improve customer satisfaction.

Transport Select Committee backs credit hire Competition Commission investigation

The Transport Select Committee has welcomed the Office of Fair Trading's provisional decision to refer an investigation into credit hire and third-party repair to the Competition Commission.

Industry must work together to tackle motor insurance costs, says Mass chairwoman

The Motor Accident Solicitors Society has called the Office of Fair Trading report into the third-party vehicle repairs issue the "tip of the iceberg" with a Competition Commission investigation almost inevitable.

ABI welcomes OFT referral as GTA rate review leaves cost unchanged

The Association of British Insurers welcomed the Office of Fair Trading's decision to provisionally refer the study into vehicle repair services to the Competition Commission criticising the exaggerated costs insurers pay for credit hire cars.

Credit Hire Organisation boss discourages potentially costly Competition Commission investigation

The Credit Hire Organisation has said that referring the motor insurance study to the Competition Commission would be similar to using a "sledge hammer to crack a nut" and could cost millions of pounds to solve the "dysfunctional vehicle repair service"…

OFT to refer credit hire study to Competition Commission

The Office of Fair Trading has provisionally decided to refer the private motor insurance market study to the Competition Commission after finding that insurers were too "distracted" with lowering costs and pushing up rivals' premiums to provide…

Your say: Voucher scheme for whiplash

Wilson Carswell, medical director at Moving Minds, speaks out in favour of a 'care not cash' approach for whiplash victims.

Application fraud: Revving up rates

In an effort to bring down premiums, many drivers are telling 'white lies' on their application forms, compelling brokers to beef up their own fraud detection alongside insurers.

North of the border: Explosion prompts negligence test

In the recent case of ICL v Johnston Oils (2012) the question was this: when should the court apply the standard of care of the reasonable man, and when should it apply the professional negligence standard?

Opinion: No more 'softly softly' approach to reservation of rights

Reservation of rights as a default position can render it impossible for insureds to finalise annual results, says John Hurrell.

Italian quake losses to hit £560m

Estimates for insured losses from the Italian earthquakes could be as much as £558.5m, it has been suggested, after a second disaster rocked north west Italy yesterday.

Post magazine - 31 May 2012

The latest issue of Post is now available to subscribers as a digital and interactive e-book.

As job cuts hit loss adjusters, firms commit to investing in future talent

The loss adjusting industry has had a tough few months but, as major firms have been forced to shed staff, they are also vowing to continue to invest in the people they have retained.

Buyers back industry preparedness for Eurozone fallout but fear claims

Insurance buyers have commended the UK insurance industry's preparations for a potential fallout if Greece leaves the Eurozone, but warned that the industry will be tested by major claims that arise out of a crisis.

Editor's comment: Taking evasive action

Failure to prepare is merely preparing to fail, or so says the oft-quoted maxim. And this week has all been about UK insurance companies demonstrating this is not a trap they have any intention of falling into with regard to the continued volatility in…

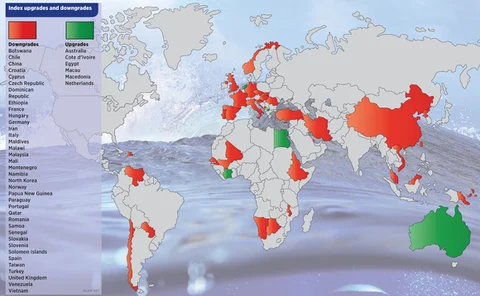

Terrorism and civil unrest: Risky business

With several parts of the world engulfed by violence and civil unrest, is traditional terrorism and political risk cover increasingly irrelevant?

Few Brits buy travel insurance for holidays, Hiscox finds

Britons are opting not to buy travel insurance for their holidays, research by insurer Hiscox has revealed.

Allianz renews GAB Robins, Cunningham Lindsey and Davies contracts

Allianz Insurance has renewed contracts with GAB Robins, Cunningham Lindsey and Davies for another two years.

The AA and Direct Line provide 'poor' online customer experience, survey finds

UK home and motor insurers like Direct Line and The AA are potentially ruining opportunities to acquire new customers because of a poor online user experience, a survey has found.

Axa, LV, Zurich, Broker Direct and QBE triumph at Post Claims Awards 2012

Mike Klaiber, Zurich UK claims disease manager, was the winner of the inaugural CII Claims Faculty achievement award last night at the Post Claims Awards.

Second quake strikes north west Italy

At least eight people are reported to have died after the second significant earthquake in nine days struck northern Italy on Tuesday afternoon.

Davies hires L&G boss Andy Webb for new COO role

Claims management company Davies has recruited former Legal & General chief operating officer Andy Webb, pictured, for the same role to start on 1 June.

In conversation with Davies: Crawford and Coombes on life with Electra

At the tail end of September 2011, the claims solutions provider Davies refinanced, with the existing management and Electra Partners agreeing a buyout that saw Lloyds Development Capital exit the business.