Insolvency

MP calls on government to force insurers to use dividends to pay coronavirus claims

Plaid Cymru MP Jonathan Edwards has tabled an Early Day Motion calling on the government to instruct insurers to put their dividends towards settling insurance claims resulting from the Covid-19 pandemic.

FSCS pays £5.6m to cover first 100 Elite claims

Following insurer Elite entering administration the Financial Services Compensation Scheme has paid out £5.6m towards claims.

FSCS declares CBL Insurance Europe in default

The Financial Services Compensation Scheme is now stepping in to protect the majority of policies sold in the UK to individuals and small businesses by CBL Insurance Europe having declared the insurer to be in default.

Unsecured creditors of Elite face around £70m shortfall

Elite’s administrators expect around £315m in unsecured claims, but have identified under £246m in assets available.

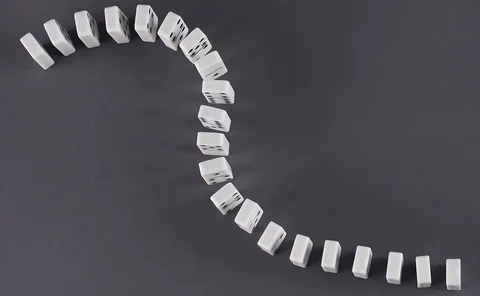

Blog: 2020 – a year of tipping points

2020 could prove to be a year of significant risk tipping points for insurers, many of them driven by fast-paced political and cultural change says Simon Laird, global head of insurance at RPC.

FSCS reveals £12.4m cost of Qudos and Lamp failures

The Financial Services Compensation Scheme has forecast that the failures of Qudos Insurance in December 2018 and Lamp Insurance in May last year will cost £12.4m this financial year.

Thomas Cook collapse drives bad debt claims to record levels

Trade credit insurers received a record £271m in claims during the third quarter of 2019, driven by the demise of Thomas Cook, according to the Association of British Insurers

Government to plough on with Thomas Cook Compensation Bill

The government has outlined plans for a capped compensation scheme for Thomas Cook customers suffering “the most serious hardship” from injuries or illness.

Elite Insurance goes into administration

Gibraltar-based Elite Insurance has been placed in administration and has ceased playing claims, having initially ceased writing business and entering runoff in July 2017.

FSCS has paid out a total £276m following the collapse of unrated insurers Alpha, Gable and Enterprise

The UK’s Financial Services Compensation Scheme has paid out a total £276m in claims to the policyholders of three overseas unrated insurers that collapsed between 2016 and 2018.

Thomas Cook personal injury fund unlikely to provide full compensation, lawyers warn

A government scheme due to be set up to pay the personal injury claims of Thomas Cook customers is unlikely to be sufficient to provide claimants with full compensation and may be open to abuse if appropriate safeguards aren’t put in place, lawyers have…

CBL Corporation delists from New Zealand Stock Exchange

CBL Corporation has delisted from the New Zealand Stock Exchange, effective from close of play today.

Insurers warned on solvency and run-off as Gibraltar regulator airs 'reputational damage’ fears

Insurers in Gibraltar must be aware of their financial position "well before" a solvency breach occurs, the regulator warned as it revealed a clampdown.

Insurers respond following Thomas Cook collapse

Insurers have responded following the failure of Thomas Cook in the early hours of this morning, which has prompted the largest peacetime repatriation in British history.

Lamp liquidator disclaims further policies

Lamp Insurance’s liquidator has disclaimed health and guaranteed asset protection policies supplied through two brokers.

Insurers 'should use data to accurately price small business risks'

Insurers should take more data into account in order to quote small businesses premiums that properly reflect their risk, Lexis Nexis Risk Solutions has said.

FSCS to compensate 14,000 Alpha policyholders as deal collapses

Some 14,000 policyholders will be compensated by the government guarantee scheme after a plan to replace cover collapsed.

30,000 Alpha policyholders to be moved to new insurer

More than 30,000 property policyholders affected by the collapse of Alpha have been thrown a lifeline in the form of alternative cover arranged by the Financial Services Compensation Scheme.

CRL deadline to transfer Alpha policies pushed back again as talks continue

CRL is making “good progress” in talks to move its Alpha policyholders over to another insurer and has seen its deadline pushed back.

CRL identifes potential alternative insurer to take on Alpha policyholders after missed deadline

BCR Legal Group appointed representative CRL failed to find an insurer to take on its Alpha policies by the May deadline set by the Financial Services Compensation Scheme, but it has been given more time as the firm has a replacement in its sights.

Claims manager appointed to handle Lamp Insurance claims

Quest Group has been appointed to manage claims for policyholders of failed Lamp Insurance.

Revealed: Unrated Gefion claws back solvency ratio after year of losses

Exclusive: Danish unrated insurer Gefion took out a further chunk of reinsurance and injected capital, after its solvency ratio plummeted to 72% in 2018.

This week in Post: Big fish, little fish, cardboard box?

It might be the name, but this week I’ve spotted some similarities between Gibraltarian unrated insurer-facing-liquidation Lamp Insurance and an angler fish, sparking some strange and slippery debate in the office.

MGA looks to relocate 13,500 customers following Lamp collapse

Exclusive: Now 4 Cover is looking to relocate policies of 13,500 of its customers, following Lamp’s descent into insolvency.