Industry recruitment and salaries set to rise

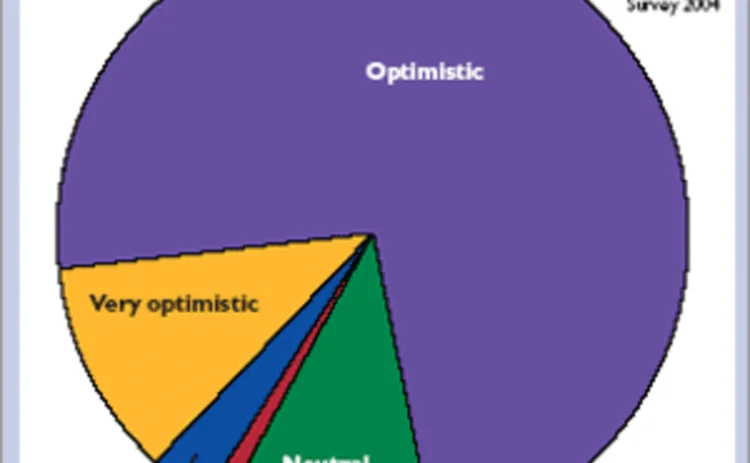

A recent survey conducted by Freshminds on behalf of Joslin Rowe shows an encouraging level of optimism in London's financial institutions. Buffy Stock says the insurance sector performed particularly strongly in terms of business confidence, though skills shortages still need to be addressed

As the second in an annual series on recruitment, retention and remuneration trends, a new survey was conducted by independent research firm Freshminds on behalf of Joslin Rowe, the financial services

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Most read

- Esure offers customers six-months free cover for latest tech glitch

- Big Interview: Jason Storah, Aviva

- Copart confirms delays to Luton Airport salvage operation