Guernsey set to see growth in captives

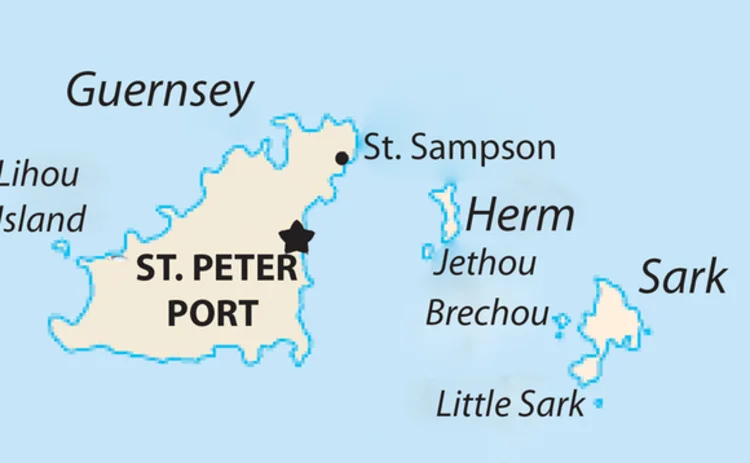

The number of captives domiciled in Guernsey is expected to increase significantly as the implications of compliance with Solvency II become better understood according to Aon.

In an event today, held at the Chartered Insurance Institute in London, hosted by Aon Insurance Managers (Guernsey) the chief minister of Guernsey, Deputy Lyndon Trott, will outline Guernsey's commitment to sustaining its position as European leader in captive insurance and one of the top four captive jurisdictions globally.

He will set out how Guernsey's industry expertise and world-renowned reputation for robust but responsive regulation will help deliver that commitment and emphasise that Guernsey will lead in implementing the International Association of Insurance Supervisors' international regulatory standards.

In advance of his speech, the chief minister said: "Guernsey has a well-deserved and hard-earned reputation for leadership and innovation in captive insurance. I will be emphasising that in Guernsey we will not be resting on our laurels, and that we will continue to lead and innovate in the months and years ahead."

Delegates have already heard while the capital requirements of Solvency II may be appropriate for commercial insurers, dealing with the general public, many captive managers and owners believe the IAIS international regulatory standards will be sufficient for most traditional captives.

Paul Sykes, managing director of Aon Insurance Managers (Guernsey), commented: "Guernsey is fast becoming Europe's leading destination for captives. It offers a stable and solid political and regulatory regime while not forcing captives to adhere to the disproportionate demands and excessive capital requirements of Solvency II.

"Increasingly this will differentiate Guernsey from other domiciles and we fully expect businesses with captives to see Guernsey as the place to do business.''

He added: "Aon is committed to Guernsey, and we are actively advising new and existing captive insurance company clients to help them achieve better capital efficiency and cost savings through restructuring their captives and reducing collateral requirements."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk