Online exclusive: Easing the customer journey

Which companies provide the best customer experience for motor and home insurance buyers? Global Reviews reveals all in its quarterly benchmarking report.

How good are insurance companies at giving potential customers the online customer experience most conducive to making people actually buy home or motor insurance products from them?

Global Reviews has been conducting customer experience benchmark studies over the past 10 years.

The studies involve four tests that measure the four dimensions of the customer experience (4CE): a set of practical tasks, an attitudinal survey and an audit of the site's features - all done by genuine prospective customers - and an audit by experts.

The process highlights the steps in the customer journey that need improving. A score of 100% means an insurance company is providing the ‘perfect online journey' - one that is very easy and effective in getting people the insurance products they need.

A score of 55% equates to an experience just adequately meeting customer needs.

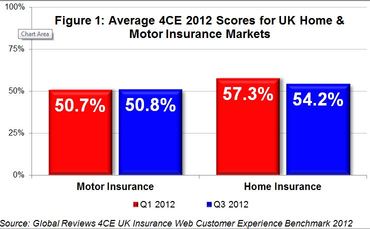

However, the home and motor insurance industries struggled to meet even this level in 2012, the motor insurance market not even reaching 51% while the home insurance market dropped below 55% between the first and third quarters.

So what were the major changes seen between the first and third quarters of 2012?

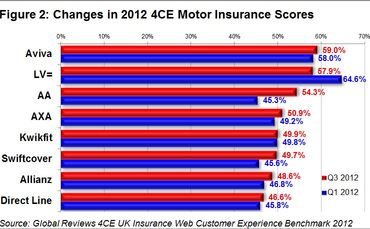

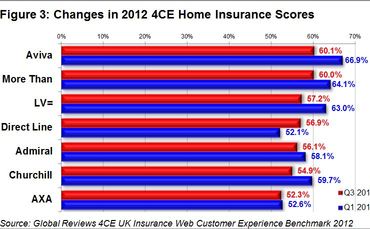

Overall, Aviva provides the best online customer experience for motor and home insurance.

In particular, it outscores the industry in terms of helping users locate and understand the product range as well supporting them in their decision making after getting a quote.

LV's contact information has become harder to find which makes it more difficult for visitors to escalate any query they might have as well as reducing their level of trust in the brand.

Contact information such as email and phone numbers (complete with opening hours) should be clearly available throughout sites including during the quote and applying to buy stages.

Aviva and More Than experienced drops in scores for home insurance; Aviva's reduction was largely down to users struggling to get quotes and the consequent dissatisfaction, while More Than suffered from a combination of changes to contact details, help access and details of options to apply.

The AA's motor insurance website score increased significantly thanks to a number of on-going improvements to its online quote system, making it a more simple process for visitors to get a quote.

As the 4CE methodology takes into account hundreds of individual criteria, website changes don't have to be major to affect overall scores.

Churchill's fall in its home insurance score was caused by a number of small site amendments such as removing some contact details which was compounded by a lack of support for visitors wanting to take the next step and buy after getting a quote as well as less clear information on alternative ways to buy such as via the phone.

Churchill also removed some privacy and security statements which run counter to the prevailing mood of consumers wanting more transparency around personal details in online transactions.

Conversely, improvements to Direct Line's quote process such as clearer links to online purchase helped increase its score.

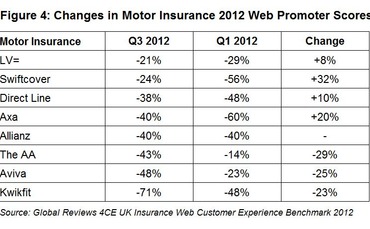

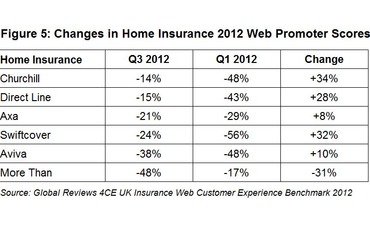

The Web Promoter Score measures the propensity of visitors to recommend a website.

It is calculated by subtracting the percentage of visitors who dissuade someone from going to a website - a detractor - from the percentage who would recommend it - a promoter.

Between the first and third quarters of 2012, several brands experienced considerable fluctuations in their Web Promoter Scores.

These are not only influenced by consumers' online experience and the competitiveness of the quote given, but their wider experience and opinion of the brand. Thus, the score is influenced by more than just site changes.

The widely negative view consumers have of online insurance websites should make for sobering reading for UK insurance companies - every single insurer scores a double-digit negative score, the motor insurance industry averaging -41% and home insurance -27%.

In motor, Kwikfit generated the lowest WPS at -71%, a significant worsening on the previous -48%, while More Than is the lowest for home (-48%).

The biggest improvers over the period were Churchill (up 34% in home), while Swift Cover improved by 32% in both home and motor combined.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Most read

- Movers and shakers who made Insurance Post’s Power List 2024 revealed

- Insurance’s wealthiest figures revealed

- Winslow continues Direct Line management overhaul