Broker - Commission: The question of commission

According to some, the trend for insurance brokers to ask for higher commissions shows no sign of abating – but is the evidence there to prove this is true?

Although there are no reliable statistics to shed light on the emotive subject of intermediary remuneration, there is certainly some anecdotal evidence pointing to a trend for insurance brokers to ask for higher commissions. Consolidation in the intermediary sector is commonly volunteered as a key driver.

When, for example, QBE Europe posted its 2015 results, its CEO Richard Pryce said not many people in the industry would find that “broker commission demands are anything other than increasing”. With the current excess of supply and clamour for business opportunities, brokers sense the opportunity “to extract a greater proportion of the premium”, he said.

Jeremy Butler, managing director of specialist scheme provider Qdos Holdings, remarks: “There is an age-old economic theory of supply and demand in many respects at play. In any market, when there is oversupply, forces dictate that prices will fall and reach equilibrium when demand meets supply. However, in the insurance market, prices do not fall in line with excess in capacity. Very few lines of business experience a significant drop in prices and, although the motor and household markets vary occasionally, they don’t do so to any great extent.

“Commercial lines might reflect a soft market but I can’t remember when it wasn’t a soft market. So this tells us there has been excess of capacity for a great many years and that there must be good profits to be made from the capital employed.

Otherwise, it would find a better home. Thus if the insurers and capacity providers are receiving profits with very little distribution cost attached, then why shouldn’t the broker enjoy better income streams given that they invariably spend all the money on marketing, technical competence and upfront expense?”

But not everyone agrees with this logic or even that such a trend is actually occurring. Pryce is “probably speculating”, says Bryan Banbury, managing director at Nottingham and Leicester-based brokers Russell Scanlan. “Maybe he’s seeing evidence I am not.”

Russell Scanlan is a member of the UNA Alliance, which represents a dozen of the country’s largest independent regional brokers, and Banbury feels it is “unlikely” that members are asking for more commission.

He explains his firm doesn’t demand more commission unless it finds that the rate is less than agreed because the insurer has made some kind of administrative error. He is adamant that his firm is motivated by what the best deal for the client is, as opposed to the commission level, and that it will only ever charge a rate it feels it can justify to the client.

He adds: “If your focus is on commission, then I don’t think you’ll be successful in the long run as you have to keep clients happy. If you look after your clients properly, then the rest looks after itself. A significant amount of the new business we receive comes from referrals from existing clients.”

Ashwin Mistry, chairman and CEO of Brokerbility, acknowledges that insurers may be caving in to demands for higher commission on property owners insurance, where he has heard anecdotally of commissions of 50% or 60% being asked for.

He feels this is because underwriters get lured into a false sense of security when using high-tech data analytics to forecast claims.

Nevertheless, he suspects in other areas insurers may have learned from the past – when the initial wave of consolidation 10 to 15 years ago led to a substantial increase in commercial lines commission levels for the largest brokers.

“Overall there is hope for more commission from brokers but they will be disappointed as insurers won’t play the game, although some of the smaller markets may be tempted to get a higher market share,” he says. “If brokers aren’t making money for the carriers, they should be prepared to make even less in commission.”

Any attempt to monitor feedback from brokers is thwarted by the fact that very few are prepared to be interviewed on the subject, making it tempting to conclude that they are keen to avoid direct questions about their own attitudes towards higher commissions. Indeed, Russell Scanlan was the only broker active in core general insurance markets to volunteer total transparency about its own dealings.

Influenced by commission levels

So, is it fair to conclude many brokers are, in fact, influenced by commission levels when recommending products to clients?

Branko Bjelobaba, founder of insurance compliance consultancy Branko, comments: “Many brokers will profess not to be influenced by commission but, after 30 years in the insurance market, I am adamant that this is not true and that it leads to clear consumer detriment.”

Ultimately, it is hard not to point the finger at the regulator for not actually making commission disclosure a hard and fast rule.

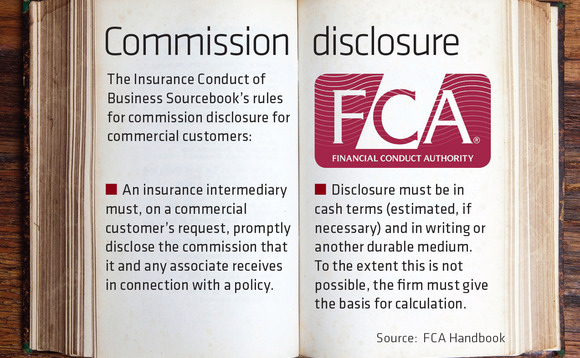

Insurance Conduct of Business Sourcebook rules do not require brokers to disclose commission to consumers. Only when a commercial customer requests the information, must the commission be disclosed. Nevertheless, ICOB also reminds brokers that they have legal obligations as an agent to the insured, and, therefore, owe a fiduciary duty to their client. One could argue that this includes a duty to disclose because the broker cannot be seen to make a secret profit.

Sara Ager, legal director, commercial and governance at EC3 Legal, notes: “The requirements of conduct risk are to be transparent to customers, so I would advise brokers to spell out the commission up front. Although the Financial Conduct Authority has deliberately left the term conduct risk undefined, leaving it for firms to define what it means, it is framed around the concept of customer outcomes. The customer needs to know what they are buying at every stage pre and post-sale, and in my view it should include disclosure of commission.”

Biba agreement

Under the agreement struck by the British Insurance Brokers’ Association with the then Financial Services Authority in 2009, commercial brokers must inform clients that they are entitled to ask what commission they are being paid. This should be made clear in the first couple of pages of their documentation at outset and renewal.

But Bjelobaba reports that, although some brokers do, many don’t. He also suggests that a broker’s moral compass would appear to be affected if commission arrangements are influencing placement of business. “Brokers should ask if the commission being received is commensurate with what they actually do but lots of juicy commissions are being paid or demanded when the broker does very little. If you have nothing to hide, why wouldn’t you want to disclose commission up front?”

Stuart Scullion, commercial director at Punter Southall Health & Protection, supports disclosure of commission both as a person and as a business. His firm volunteers up front its remuneration to corporate private medical insurance clients.

Scullion is also chairman of the Association of Medical Insurers and Intermediaries and he says that if he was the regulator, he would make it compulsory for all earnings to be declared as part of the initial report given to both retail and corporate clients. “Advisers should be saying they have taken years to gain their experience and this is, therefore, what they are charging. If everyone had to do it, then no one would be disadvantaged.”

One-third of Punter Southall Health & Protection’s corporate PMI clients, in fact, operate on a net terms fee basis. Scullion emphasises that this has a positive impact for P11D purposes [expenses and benefits for employers]. But he acknowledges that if a client talks to a number of intermediaries, they could be offered different terms from the same provider.

Robin Belsom, director at Ipswich-based brokers Ryan’s, regards net rates as “an interesting option” but expresses similar reservations. “How do you decide how much to charge one customer as opposed to another?” he asks. “The broker would need to have a fair and consistent approach to the income charged per case.”

Fee paying is more transparent and more directly linked to the work done than commission. It is reasonably common on general insurance premiums of more than £50,000 but Mistry would like to see it become compulsory from £25,000. He points out that the recent increases in insurance premium tax have weakened the case for commission by bumping up the premium. He feels that the rise to 10% due to be implemented this October may not be the end of the story, as IPT is often 20% elsewhere in Europe.

James Daley, founder of Fairer Finance, is among those who feel that having a standardised commission rate could be another viable solution. He recalls how during a previous career as a business journalist, he was struck by the way in which insurers boasted how they increased sales by putting up commission but “always fudged the issue” when talking on the consumer side.

“It is human nature to try and make as much money as possible, so the responsibility ultimately lies with the regulator to implement a flat rate of commission,” he says. “Alternatively, I appreciate the point that if you ask customers to pay up front, you risk killing the market, but you can still have something that looks like commission. For example, an adviser can say it will cost them £500 to sell the policy and that the client can either pay this up front or allow it to be taken from the premium over the policy term.”

Less secretive

Insurers are noticeably less secretive than brokers on the subject. Zurich, Hiscox, LV, Aviva and Axa all have no problems with acknowledging that they are prepared to pay higher rates of commission in certain cases, with much depending on the volume, quality and cost of doing business generated.

But they commonly stress that they strive to ensure that this does not result in any detriment to the customer and that they look carefully at the justification and rationale that sits behind requests for higher commission.

One area in which they differ, however, is with regard to whether broker demands for higher commission is a distinctly recent phenomenon. LV reports that with increased broker consolidation, there has been greater demand for additional commission, but Axa says that the situation has been going on for several years.

Another area of disagreement concerns the product lines being affected. Axa says that it is not something peculiar to any particular area and can happen with any product. However, Aviva refers to areas of the market it is especially concerned about, most notably property owners insurance.

Phil Bayles, chief distribution officer at Aviva, says: “It is not unusual to see commission levels of 35% to 50% on property owners business. Much of this is paid away to managing agents by brokers but it is difficult to see this level of distribution cost as being reasonable for end customers, and the market lacks transparency for customers as well. I am sure this will continue to attract regulatory interest, and we would support changes that introduced more transparency and better customer outcomes in terms of value for money.”

The fact that there are frequent calls for the regulator to revisit the area of broker commission certainly seems ominous, and if brokers fail to put their house in order it is probably only a matter of time before it gets done for them.

The Biba agreement was struck up to stave off compulsory disclosure of commission but rumblings of discontent seem too numerous to be able to conclude that the system is working effectively. However, the market could be getting closer to compulsory commission disclosure, which could lead to a mandatory fee-based structure of remuneration.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Most read

- Civil injury fraudster caught out by ‘Jeremy Kyle’ appearance

- Covéa shrinks staff numbers by almost a third amid further losses

- DLG or Esure – which Peter Wood baby is most likely to bounce back?