Consolidation

Dunny or delight? Rating Australian forays into UK insurance

Content Director’s View: With Australian firm AUB Group doubling down on its UK growth plans with a deal for Prestige Insurance Holdings, Jonathan Swift reviews other notable Antipodean overseas insurance expansion plans to assess its chances of success.

Big Interview: Craig Bundell, Tesco Insurance

With Tesco Bank now owned by Barclays, Craig Bundell, CEO of Tesco Insurance & Money Services, is carving out a future for his business that includes accelerating growth by using Clubcard data to build frictionless, personalised insurance experiences for…

Is pet insurance pulling on the leash or coming to heel?

Almost six years on from the Covid-19 pandemic, Scott McGee examines how the pet insurance sector has adjusted, how premiums have evolved, why new entrants are arriving, and where the market could be heading.

How Belfast’s insurance sector is overcoming Brexit blues

As Belfast enters a new year of investment, consolidation and post-Brexit adjustment, Tom Luckham examines how its insurance sector is proving resilient, fast-growing and increasingly strategic for both UK and Irish markets.

Big Interview: Robert Kennedy, Howden

Howden’s UK and Ireland CEO Robert Kennedy shares his growth plans for the business and explains why the broking giant won’t abandon the high street any time soon.

Four biggest challenges facing insurers in 2026 revealed

Insurance Post reveals the four main challenges general insurers face in 2026 and the solutions experts from EY, the International Underwriting Association, AM Best, Moody’s, S&P, KPMG, Pathlight Associates and Sicsic Advisory say will matter most in the…

Five insurance M&A storylines to follow in 2026

As we bid farewell to 2025, Post content director Jonathan Swift highlights the M&A storylines that might make the transition from rumour to reality next year and beyond.

Insurance Post’s star-studded Christmas Special for 2025

The award-winning Insurance Post Podcast has signed off the year with a Christmas Special featuring industry heavyweights, newsroom favourites and even a CBeebies-style bedtime story.

MGAs Review of the Year 2025

2025 was a landmark year for MGAs, marked by record growth, major partnerships, technological innovation and expanding global reach, even as soft market conditions and pricing pressures tested resilience across the sector.

Q&A: Nikki Lidster, Zurich

Zurich UK’s head of SME Nikki Lidster talks to Insurance Post about the firm’s growth in 2025, its plans for 2026, and how it revamped its products this year.

Insurers Review of the Year 2025

Insurers managed to post profits amid a softening market in 2025, invested in technology and pushed to reaffirm the industry’s vital role in protecting society with the Labour government and regulators.

Headlines I hope to see in 2026

Deputy Editor’s View: With the year drawing to a close, Scott McGee looks back at what he thinks are the main themes of 2025 and how they could develop in 2026.

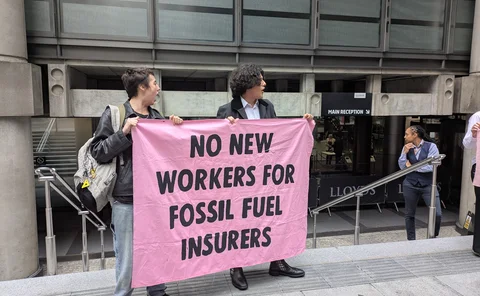

Climate activists disrupt S&P insurance conference

Climate change protesters disrupted S&P Global Ratings’ European Insurance Conference in London this afternoon (20 November), forcing multiple pauses to the programme.

Does Intact’s UKGI investment signal a new era of insurers buying into brokers?

Content Director's View: With Intact investing into the owner of Addler Fairways, are we about to see another dawn of insurers buying into commercial insurance distribution? Jonathan Swift weighs up the lessons of the past and present to find an answer.

Halloween horror stories haunting insurers

Editor’s View: It’s that spine-tingling time of year again, when the nights draw in, shadows lengthen across Leadenhall Market, and Emma Ann Hughes shares scary stories about insurance.

Top 100 UK Insurers 2025: Allianz

Allianz is ranked tenth again in Insurance Post’s Top 100 UK Insurers list thanks to disciplined pricing, new partnerships, and digital transformation.

How insurance can realise the personalised motor policy dream

Damisola Sulaiman analyses the landscape of usage-based motor insurance, including its tailwinds, previous failings and recent innovations that may turn the personalised motor insurance dream into a reality.

What will impact UK motor moving forward?

Given predictions of the UK motor insurance market going back into the red next year, experts have outlined the factors likely to impact performance and how the industry can mitigate those pressures.

Technology due diligence takes centre stage in insurance M&A

From costly integration to toxic technology debt, Scott Thomson, insurance solutions director at FintechOS, explains how outdated systems are blocking insurance takeover deals.

Zurich capacity deal; Dual’s HNW partnership; Marsh’s CCO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Can debt-heavy brokers survive rising rates and scrutiny?

Leveraged buyouts have transformed the UK broking sector into a private equity powerhouse, but with debt costs climbing and organic growth harder to achieve, Emma Ann Hughes reveals questions are mounting over how sustainable the model really is.