High net worth (HNW)

Interview: Katie Small: Carving a niche

As RK Harrison’s head of private wealth – and its first female board member – Katie Small is a big believer in specialist solutions. She tells Post about her journey to success and reveals her plans to grow her division

Interview: Steve Langan: Onwards and upwards

Concerned that the wider industry is dangerously out of touch when it comes to technology, servicing customers and advertising, Hiscox UK managing director Steve Langan tells Post how his firm keeps up with the times.

Aqua relaunches HNW home wordings

Aqua Underwriting has moved to revitalises its high net worth home wordings to enhance cover, expanding the range of risks protected.

Interview: Chris Hall - A quest for success

A decade ago Chris Hall led a small team that risked it all to buy loss adjuster Questgates. Now it is worth £11m – and the managing director hopes to double that figure within the next 10 years.

High Net Worth: Worth the effort

Research by Home & Legacy suggest there is little consensus in what constitutes a mid or high-net-worth customer. But what does this mean for the market?

Oak MD Trott to retire

Bob Trott, who has led Oak Underwriting since 2003, is to retire at the end of June, with RSA personal lines broker MD Jill White set to temporarily replace him.

RSA launches private client offering

RSA is to launch a private client division that will be based in Chipping Norton with a regional presence across parts of the UK.

R&Q recruits two to high-net-worth MGA

Randall & Quilter’s high net worth managing general agent Synergy has recruited underwriters from Chubb and Gallagher Heath.

HNW motor insurer to target ‘super-younger’ demographic

Aqueduct Underwriting’s high net worth and specialist motor product Aurum has noted a gradual but significant demographic shift to ‘super-younger’ drivers in spite of the continuing economic hiatus in the UK.

Career file - Steve Hook: Ex-Aon Hook to head up HNW at Bluefin

Bluefin has appointed Steve Hook as head of high net worth, in a role that will see him report to managing director of private clients Tim Mortimer.

Barbican joins Home & Legacy panel

Barbican is set to join the household insurance panel of high net worth specialist Home & Legacy.

High Net Worth: Rich Pickings

With an increase in providers of high net worth insurance in recent years, wealthy customers have plenty to choose from. What can firms do to stand out from the crowd?

Criterion swoops for Cunningham HNW lead

Loss adjuster Criterion has bolstered its ranks with the recruitment of Cunningham Lindsey’s private client services division founder, Sean Ball.

Pound weakness presents HNW opportunity

The pound’s weakness is an opportunity for international high-net-worth providers, wholesale broker Markham Private Client has said.

Hiscox launches private client offering

Hiscox has launched a new private client agency, which will operate as a wholly-owned tied agency offering the insurer’s products.

Markerstudy backs HNW start-up

Markerstudy is backing a new motor high-net-worth managing general agent by providing 100% of its capacity as well as a bespoke claims service, and logistical and advisory support.

Stackhouse Poland completes LFC acquisition

Stackhouse Poland has increased its gross written premium "closer to the £100m barrier" with the acquisition of the business of LFC Insurance Brokers.

L&G targets HNW customers with new home insurance product

Legal & General has followed up on its vow to expand the range of personal lines products it offers, by launching a bespoke product designed for customers in the mid and high net worth market.

Plum launches MNW focused home product

Specialist household provider Plum has launched a new home insurance product, while HNW broker Castleacre has revealed that property rates can vary by as much as 8%.

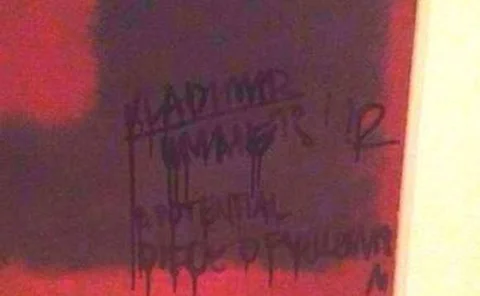

Rothko vandal jailed for 'unacceptable' crime

The man who defaced a Mark Rothko mural at the Tate Modern in October has been sentenced to two years' imprisonment.

Europe View from the Top: Turning the telescope around

Research by Ernst & Young entitled Turning risk into results, launched at the Federation of European Risk Managers Association, brings positive news.

Fine art: State of the art

The sky-high value of fine art necessitates appropriate cover but, as well as the obvious threat of theft, what else must be considered when insuring artwork?

Markel places collectables cover on broker e-trading system

Specialist insurer Markel UK has launched the first personal lines product on its broker e-trading system.

Chubb HNW offering receives facelift

Chubb is revamping its high net worth underwriting and account handling teams in a bid to make its offering more relevant to brokers.