Claims

Inclusive practices boost engagement for female managers

Nikki Richmond-Jones, claims and assistance director at Charles Taylor Assistance, explains how empowering women at work drives retention, performance, and career progression.

Marine insurance to navigate choppy waters

How geopolitical tension, supply-chain bottlenecks, climate-driven weather extremes and surging regulatory oversight are making marine insurance challenging is the focus of the latest Insurance Post Podcast.

Pet insurers with the most satisfied customers revealed

Fairer Finance’s latest survey shows the impact of an animal’s age on policyholders satisfaction with their pet insurer, plus which provider has the happiest customers is revealed.

Why gender equality in insurance demands action

As International Women’s Day 2026 approaches, Kellie Leigh, HR and communications director of the Insurance Claims Accommodation Bureau, reflects on how intentional culture, inclusive leadership and practical action are vital to turn rights into real…

British Insurance Awards 2026 deadline extended

For those of you rushing to put the finishing touches to your 2026 British Insurance Awards entry.

Average storm claim value more than doubles since 2017

Recent data has indicated the rising cost of covering storm damage, with the average cost in 2025 reaching £1,242.

Sign up for Claims Club to hear from London Fire Brigade and others

Fire risk in residential and mixed-use buildings is evolving in ways that are not always fully captured by data, models or regulation.

Big Interview: Andrew Burke, HSB UK & Ireland

After stepping back from executive life to spend more time with his three daughters, Andrew Burke has returned as CEO of HSB UK & Ireland with plans to grow the specialist insurer and strategic partnerships.

How to effectively estimate commercial rebuild costs

This eBook explores the importance of accurate rebuild cost estimation, analyses the factors driving underinsurance across the UK, and provides recommendations for insurers to best equip themselves with the tools and insights to close the gap.

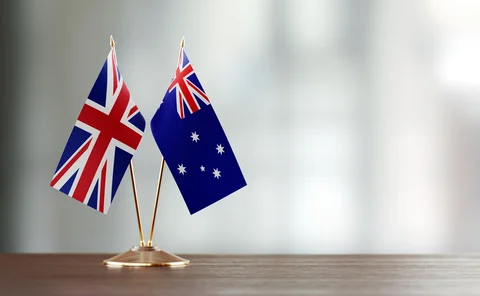

Dunny or delight? Rating Australian forays into UK insurance

Content Director’s View: With Australian firm AUB Group doubling down on its UK growth plans with a deal for Prestige Insurance Holdings, Jonathan Swift reviews other notable Antipodean overseas insurance expansion plans to assess its chances of success.

Minster Law reports improved profitability

Minster Law has reported improved profitability for the year ending June 2025, while also targeting a milestone level of turnover by 2030.

Geopolitical instability and trade policy risk rocking marine insurance

Escalating geopolitical tensions, from conflict-driven shipping attacks and vessel detentions to sanctions, tariffs and the growth of shadow fleets, are reshaping global trade routes. Against this backdrop, Tim Evershed observes significantly heightened…

Property claims cost insurers a record £6.1bn in 2025

Insurers paid out a record £6.1bn in property claims in 2025, according to the Association of British Insurers’ latest data.

60 Seconds With... M2 Recovery’s Matt Green

Matt Green, non-executive director at crypto recovery firm M2 Recovery, talks lost digital money, landmark cases, and sending his first paycheck to a Kenyan school.

Why 70% of UK properties remain underinsured

Seven out of 10 UK properties remain underinsured, according to RebuildCostAssessment.com latest data, leaving owners exposed to increasing rebuild costs.

Enter Best Insurance Employer 2026 today

If you work for one of the greatest employers in the insurance industry and want to shout about it, make sure you complete Insurance Post’s Best Insurance Employer survey today.

Insurers argue furlough deductions permitted by policy wordings

Insurers finished their submissions to the Supreme Court on the issue of whether or not furlough payments are deductible from Covid-era business interruption claims payouts this morning (12 February), hitting back at arguments advanced yesterday by…

Supreme Court hears arguments on Covid claim furlough deductions

The Supreme Court heard arguments from both policyholders and insurers yesterday (11 February) as to whether furlough payments are deductible from Covid-era business interruption claims payouts.

Why alignment with suppliers is key to good customer outcomes

View from the Top: Jeremy Trott, claims director at Ecclesiastical, says insurers must ensure they have an ‘alignment of ethos’ with their suppliers to ensure good outcomes for customers.

UK motor insurance once again hits record claims payouts

The Association of British Insurers has today (11 Feb) revealed UK insurers have once again hit record payments for motor claims.

Regulatory ripple effect of the Which? insurance complaint

The Financial Conduct Authority’s response to Which?’s super-complaint about home and travel insurance, and the regulatory ripple effects now facing the industry, are the focus of the latest episode of the Insurance Post Podcast.