Industry united in call for FCA to be appointed CMC regulator

Insurers have rallied to support the Association of British Insurers' call for the Financial Conduct Authority to oversee the regulation of claims management companies.

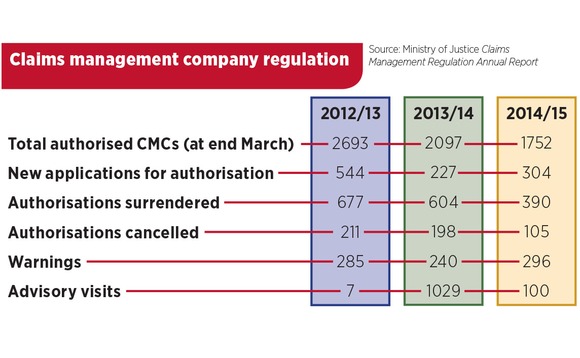

The ABI called for a new, tougher regulator to be appointed as it released data that showed 23% of CMCs were either warned or had their authorisation cancelled during 2014/15. The ABI said: "The current system is failing to provide enough of a deterrent to rogue firms."

The trade body said the FCA would be "better placed" to regulate the sector, as it would also be able to gauge the financial impact of the actions of rogue CMCs.

The Ministry of Justice, which currently regulates the CMC sector under the guise of the Claims Management Regulator, told Post that in the 2014/15 period, 296 firms were warned and 105 had their authorisation cancelled. A further 390 companies surrendered their authorisation.

However, according to its annual review, the MoJ received 304 new applications from CMCs to operate during the period, which is an increase on the 227 received in 2013/14 but not as high as the 544 applications in 2012/13.

Tony Newman, head of motor claims at Allianz, blasted the current regulatory system and told Post: "Despite warnings and lost accreditation CMC practices have continued or even worsened. In essence it has had no effect. That demonstrates that current regulation is ineffective."

He added: "The number of authorised CMCs may have reduced but many will have set up shop without authorisation. Authorised business may also just become bigger businesses, controlling more claims. The fact is that no matter what the official figures are regarding authorised CMCs, activity has increased to the point where cold calls have become a part of everyday life."

Martin Milliner, claims director at LV, echoed the calls for the FCA to take over regulation of CMCs and said that he was not surprised by the high number of punishments dished out by the MoJ.

He explained: "It's not surprising that the number of CMCs being warned or actioned has increased since last year. With complaints about cold calling from consumers rising by 12% year on year, the Claims Management Regulator had to respond. We welcome the ABI's call for CMC's to be independently regulated by the FCA and held to account for their unscrupulous practices."

Adrian Furness claims director at Covéa Insurance, also agreed that there is a need for more effective regulation of the sector.

He told Post: "The increasing number and severity of sanctions handed out to CMCs demonstrates a clear need for regulatory change to better protect the public from the harmful effects of their activities."

However, one industry expert, who preferred not to be named, questioned whether the number of sanctions would have been higher than 23% if the FCA was in charge of regulation.

They warned: "Would it be worse under the FCA's watch? That is what you have to ask yourself. But there is clearly a problem with rogue companies and there is a need for tougher regulation."

Newman suggested insurers should develop a new system that would allow claimants to deal directly with insurers, which would eliminate the need for CMCs to be involved in the process.

He explained: "A system that encourages people with soft tissue injuries to deal direct with insurers, in a way that they are comfortable with, and which involves tariff damages that would remove the need for any expertise to value their claim. Do this and the demand for CMCs would fall away."

Speaking in a recent interview with Post, Heather Wheeler MP, chair of the All Party Parliamentary Group for Insurance and Financial Services, vowed to work with the MoJ to "make examples" of rogue CMCs.

She said: "We can have a conversation with the MoJ about how we can help them to actually outlaw these sorts of things, and make examples of people."

The Association of Personal Injury Lawyers added its voice to the growing concern about the behaviour of some CMCs, and questioned whether there was a need for them at all.

Apil president Jonathan Wheeler told Post: "Apil has always been concerned about the activities of CMCs, so any further scrutiny is welcome. There is no real need for injured people to use a CMC. They should cut out the middle man and go straight to an accredited lawyer."

In the face of growing criticism and discontent from the insurance community, an MoJ spokesman assured Post that the government and the regulator was doing all it could to eliminate bad practice in the sector.

He said: "The government is cracking down on this malpractice. We are doing all we can to get consumers a fairer deal and rid the industry of rogue behaviour."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk