Spotlight on ADAS systems and implications for insurers

Need to know

- ADAS means improved safety but only if the systems can be maintained correctly

- The industry is unsure as to who exactly should take responsibility for checking the calibration systems

- A code of practice has been developed to tackle the issue of correct calibration

With 40% of vehicles set to be fitted with ADAS systems by 2020, the maintenance and calibration of these systems is a cause for concern for insurers

Over recent months vehicle manufacturers have been introducing Advanced Driver Assistance Systems at an increasing pace. More than 10% of vehicles are already fitted with ADAS systems and this is set to grow to 40% of all vehicles on UK roads by 2020.

This is great news for improving safety on our roads but there is significant concern at the lack of consideration manufacturers have given to the maintenance of these systems, even in their own dealer networks. It is clear that vehicle manufacturers need to start talking to insurers and the aftermarket without delay.

The issue of ADAS camera calibration is here and now. National Windscreens has already undertaken more than 1000 calibrations and the numbers are growing rapidly.

Increasingly vehicle manufacturers are using ADAS to ensure their vehicles meet the highest European safety ratings. The safety ratings of the European New Car Assessment Programme were changed earlier this year, meaning any new vehicle wanting to be granted the prestigious five-star rating requires two separate ADAS systems: autonomous emergency braking and lane departure warning.

The main cause for concern, however, remains the apparent lack of planning that has been undertaken by the vehicle manufacturers around calibration of the forward-facing cameras found on or around the vehicle’s front windscreen. These cameras are a core part of most ADAS systems and if the camera is not correctly calibrated – after a windscreen replacement, for example – then the ADAS systems may not work correctly.

Maintaining standards

In the aftermarket it has become apparent that maintaining vehicle safety standards and customer service at acceptable levels relies on the repairer being able to undertake the camera calibration at the same time as the windscreen is replaced.

Yet this remains one of the core areas lacking consideration by the vehicle manufacturers.

Our research shows almost 75% of senior decision-makers in the motor claims sector consider it likely that they will insist on ADAS calibration being undertaken at the same time as a replacement.

With the vast majority of vehicles requiring calibration in workshop conditions, based on manufacturers’ recommendations, it is clear that a national network of combined fitting and calibration centres is the only way such a service can be provided.

Providing regional calibration centres, as opposed to a national network, clearly means that service and safety cannot be maintained at acceptable levels following a windscreen replacement. There will be an inevitable delay between any replacement being undertaken and the calibration then being undertaken at a separate location.

This delay and inconvenience for the motorist will increase the likelihood of the vehicle being driven without a calibrated camera and accordingly with safety systems not functioning correctly. It will also undoubtedly increase costs and administration, with the replacement and calibration being undertaken at separate locations at different times.

Cameras and car safety

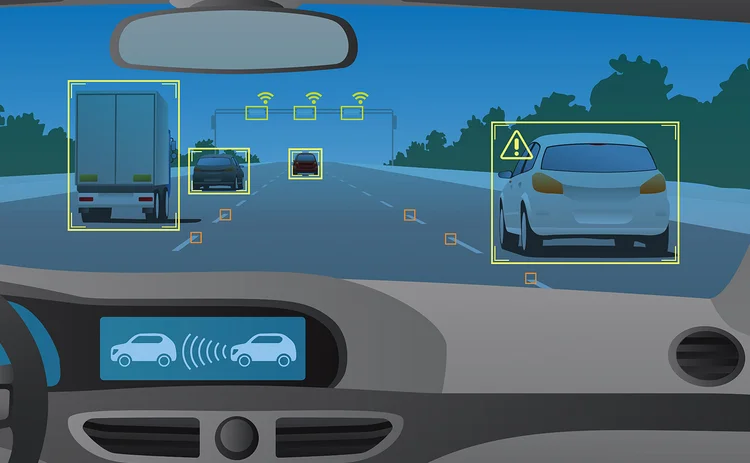

Most features of ADAS rely on cameras mounted on windscreens to operate

effectively and the correct calibration of a mounted camera is vital to the safety of the vehicle.

To find out more, please visit www.nationalwindscreens.co.uk/advanced-driver-assistance-systems

Different structure

The UK windscreen replacement sector is structured very differently to mainland Europe. In the UK, the majority of windscreen replacements are undertaken by mobile technicians, whereas in continental Europe, workshop-based replacement remains most popular.

With insurers putting ‘reduction of accident frequency’ and ‘reducing whiplash claims’ as the two most important benefits of seeing more ADAS systems on our roads, there can be no doubting the importance and impact of this technology.

However, these benefits can only be realised if the aftermarket is equipped to maintain these systems.

More than 50% of insurers indicated that they would view the repairer as liable if the ADAS camera has not been calibrated correctly and the motorist has not been informed of this requirement. With calibration required not just after windscreen replacement but in situations ranging from changing a tyre brand, to wheel alignment or an accident, this clearly affects the whole aftermarket.

Is the driver aware that their vehicle has ADAS? Are they aware the camera needs calibrating after replacing the windscreen? Is the vehicle dealer aware?

Calibration can be done in four ways. There is no one system for every vehicle manufacturer but who should have the calibration equipment - the dealer, the bodyshops, or the glass replacement companies? Without clear answers, the continued safe operation of ADAS systems may be in jeopardy in many cases.

Windscreen-mounted cameras also add to the number of windscreen models that are available for the same vehicle, adding to the complexity of selecting the correct glass for the job. Software is available that identifies the exact piece of replacement glass needed for a specific vehicle and if it has a windscreen-mounted camera fitted.

It is clearly imperative to make sure any workshop carrying out automotive glass work is calibrating correctly and providing a certificate to prove it, helping to ensure our roads are even safer places for everyone.

Code of practice

In conjunction with Thatcham Research, we have developed an ADAS code of practice designed to help tackle these issues. Issued in July this year, the code of practice determines the calibration process, specifies the advice to be given to customers (pre- and post-windscreen replacement) and requires the issue of a successful calibration certificate. If calibration is not successfully completed, the code of practice requires the motorist to be advised that the ADAS systems may not be relied upon to work correctly. This is a big step forward but there is still much work to be done to ensure the whole industry is reacting appropriately to this latest technology.

Our research shows 58% of insurers do not believe motorists will end up paying greater premiums and excesses because of ADAS safety technology costs. However, if this technology significantly reduces accidents and whiplash claims, then will there be big pressure for insurers to pass any savings on to motorists?

There are many other questions to answer. Improved safety is expected to reduce claims value, but how does this compare to the increased cost of repairing or replacing damaged ADAS equipment? Who will meet the cost of calibration? Will it be necessary to introduce approved calibration providers? Will mandatory calibration be required and with what frequency? All these remain to be answered as the industry seeks to understand the implications of ADAS systems.

ADAS means improved safety but only if the systems can be maintained correctly.

To read the first part in this Spotlight series on ADAS and to find out about insurer repairer networks, click here.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Most read

- Civil injury fraudster caught out by ‘Jeremy Kyle’ appearance

- Covéa shrinks staff numbers by almost a third amid further losses

- DLG or Esure – which Peter Wood baby is most likely to bounce back?