Interview: James Woollam: An independent spirit

Young broking boss James Woollam, MD of Hayes Parsons, discusses the lack of advice available for fledgling directors as he sets his sights on turning the Bristol-based company into a £40m GWP firm via organic growth and acquisition.

When the phone rings with a takeover offer, most broking bosses would probably entertain the notion at length, but not so for Hayes Parsons managing director James Woollam, who is mastering the art of a polite ‘thanks but no thanks'.

The Bristol-based broking boss says the independence tag his firm has traded on for more than 50 years is crucial in the firm's 10-year plan.

"I've had my first [takeover] offer, which is good," Woollam says. "I'm 34 years old, I'm not planning on retiring just yet and I would very much struggle to be told what to do, so we're not going anywhere.

"We have a 10-year plan that tells us we'll be independent, we intend to be the last independent broker in each of our niches and we will be at £40m [gross written premium]."

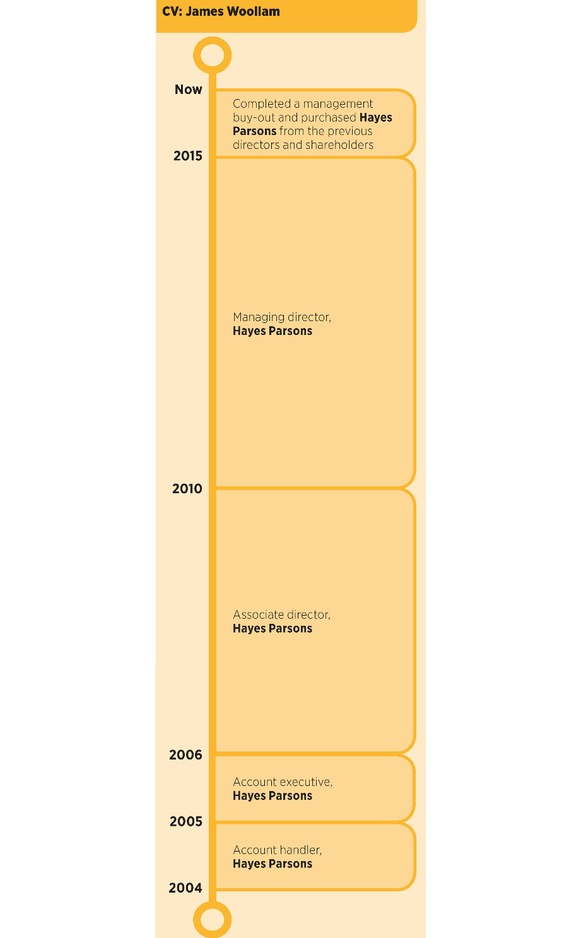

Woollam is now one of two directors and owns 85% of the business along with fellow director Ben Leah, following a management buyout from founder George Hayes last year. The buyout was on the cards for a long time before Woollam took the reins in January 2015.

"There are two directors on board, we have no external shareholders, we have no agreements with anyone in terms of the business that we place, so we absolutely work just for the client and that gives you an amazing amount of freedom," he says.

"The transition's gone as well – if not better – than can be expected and we've done very well with the retention rates. We tend to run above 95% in terms of retention."

Woollam concedes the £40m GWP target in 10 years is aspirational, but insists it is still very achievable.

"We finished our first year at just over £11m and we're on target. We have a three-year plan and the first year of that plan was always slightly transitional, making sure that everything beds down," he explains.

"At £40m I can continue with the business doing what it's doing, continue the independence side. If we were to get to a more significant number that we'd need to change the way we do things, the whole business would change in the way it's managed, and it's not something that excites me."

Achieving that target would place the company firmly within the ranks of other larger independent brokers like Higos Insurance Services, BHIB and James Hallam, all currently handling premiums over the £40m mark.

But to get there Woollam believes the company will have to start acquiring.

"To get to £40m, you'll see something like 50% organic growth and 50% through acquisitions. We're going to be pretty fussy if we do acquire; we have a criteria that we will be looking to stick to," he says.

While he wouldn't reveal areas under examination, he confirmed that the broker is already looking into possible targets.

"We would either acquire to boost one of our niches or go into another niche or potentially to get more of an understanding of technology. It would be wrong to say there aren't [acquisition] opportunities that we're already considering, but we'll make sure we get it right," he says.

Independence isn't for everyone

It would be hard to find a louder cheerleader for independence, yet nevertheless Woollam still thinks the big consolidators have their role to play in the market.

"We're not being critical of the big companies; they've absolutely got a place and their economies of scale are very attractive. They've got a place but so do we and ours is pretty exciting."

Flexibility is the key benefit he cites in the case for independence, adding that it's something that can have real benefits for the client.

A recent example he mentions is when one client fell victim to a very significant fraud incident.

"We were able to speak to all of our major clients and inform them that this kind of fraud was happening, give them some risk management tips on avoiding it, and give them an insurance solution if they want to take it, and train our staff in it, all within a couple of days," he says.

"For some large brokers that's something that could take them months. Things are changing at a quicker pace and clients are becoming more and more demanding, both of service and also that they want an insurance provision that is actually written for them. As that happens, the challenge is for large brokers rather than us because we're able to be that flexible."

He says in the wider market, consolidation will certainly continue this year, with the nationals also becoming more and more acquisitive, but there will be a flip-side to this.

"You will see brokers fall out of that and you will see a number of new start-ups, but they're likely to be smaller start-ups and actually become appointed representatives of some of the firms," he says.

"But the differences from the old days that I see is one; the [Financial Conduct Authority] and the costs associated with that, and also two; brokers today are not the same as brokers 20 years ago who just got out there and won business, there's much more of a whole system in place now for brokers coming through and actually starting up on your own it can be quite scary."

Train hard or go home

It's a young team in charge at Hayes Parsons – fellow director Ben Leah is 36 years old and Woollam, now 34, took up the mantle of MD at just 28.

Woollam says he found little in the way of support from external professional groups when he stepped up to that level, which required a new range of HR, finance, legal and compliance skills not normally part of a broker's repertoire.

"The one thing that came out of us doing what we've done is that there was very little advice, very little help; we've worked it out as we've gone through," he says.

"The likes of [the British Insurance Brokers' Association], [the Chartered Insurance Institute] and other industry organisations; there's not a lot of advice there for young brokers and brokers trying to start businesses." He says those organisations really need to step up to the plate on this and also argued that insurers should play more of a role.

He says those organisations really need to step up to the plate on this and also argued that insurers should play more of a role.

"It's an acknowledged fact that independent brokers are often favoured by insurers because they are seen as being close to the clients, understanding their clients' needs, and actually returning some very profitable insurance accounts," he says.

"If they really want independent brokers to thrive, one of the key areas that's missing at the moment is actually giving them a skill set. Without going on a very expensive degree or course there's not a lot of support out there."

He says the other aspect holding back start-ups was securing achievable finance.

"There's not a lot of start-ups that actually become significant insurance brokers anymore, which is a real shame," he says.

The training gap is something Hayes Parsons puts its resources into; taking on two trainees each year, bringing in external trainers to help them and encouraging staff to obtain their professional CII qualifications.

"We're talking to our local schools, we're getting two trainees in a year, we try not to lose those at the end of the year and we haven't yet. If other people did similar things, then this wouldn't be so much of a conversation in the future," he says.

"We don't need to be going out and trying to compete for the few coming through, what we need to be doing is going out there and making more come through to insurance.

"If you go out there to job fairs, you see five to 10 lawyers, five to 10 accountants and they're seen as really serious, professional industries to join. You don't normally see anything in the insurance world and if you do it is incredibly dull."

He says when his firm brings trainees into the office to spend a day with the company, they actually come away surprised at what the sector can offer.

"We, as an industry, are failing to make insurance exciting. I find a lot of adverts, a lot of the websites, a lot of the professional sites quite boring and actually insurance is a really interesting thing to do," he says.

"I've been fairly critical of us as a trade, as an industry, getting new people into the business. We just don't do a good job, we really don't."

The company has already seen one of its trainees, Ryan Legge, crowned joint winner of the young broker of the year title at the Insurance Age UK Broker Awards last year.

Woollam agrees the field needs to improve its image as a profession, making proper qualifications the norm. Hayes Parsons requires its staff to be qualified to work there and, while he says the company sees it as a differentiator, it's something he hopes will change.

"To get the industry to really sign up to the professional side, it needs to actually be dictated from the top. It's a really expensive thing to do at a time when everyone is looking at their cost basis."

He adds: "Too many people tell you too many times we do something because it's always been done like that; insurance is done like this because it's been done like that[for years], and that's something that we should never say."

Stimulating growth

While the firm's 95% retention rate is high, Woollam emphasises it takes a lot of work to maintain that level, alongside a growth rate that reached 12.5% in 2014.

"In the last five years we've had double digit growth every year; that's all organic and the intention's obviously to continue doing that. Part of it is about keeping the clients that you've got; they say it costs five to 10 times more to pick up a new piece of business than it does to keep a renewal," he says.

Of the company's key sectors in marine trade, real estate, education, charity and technology; Woollam says real estate is providing the most growth at the moment but technology has strong potential.

"Bristol has been identified as a really significant tech hub, it's a really interesting and exciting area, it's something that we're looking to develop further," he says.

"As start-ups, you're talking about very low value premiums and therefore very low value commissions so actually you need to understand you will probably take a loss at the beginning but if you stick with them and one or two come off, then that will absolutely pay back."

A decade from now, he hopes to be in charge of a £40m business and says the company is well on its way to achieving that.

"The 10-year plan we put in place that for us is a promise, it's a promise to our staff, our clients and suppliers," he states. "We will always be very attractive so long as we continue doing what we're doing."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk