Blog: Injured claimants are not lobby fodder

Need to know

- Individual insurers are taking various initiatives to improve their reputation

- However, the ABI is alienating the public with its reaction to the discount rate decision

- The whiplash reform the ABI is lobbying for won’t generate the promised £40 savings for motor policyholders

I spent 15 years working for a number of insurance companies before ‘crossing the floor’ to be the managing director of Minster Law, a claimant firm. Whether moving from insurance to the law is a step up the public approval rankings or a step down is a moot point.

Many people would agree with Dick the Butcher in Shakespeare’s Henry VI, who memorably suggested: “The first thing we do, let’s kill all the lawyers” as a way of improving the country. “Let’s kill all the insurance executives” doesn’t have the same theatrical cachet.

But, in defence of my legal colleagues, I was surprised and impressed to discover that individual lawyers are trained to go to huge lengths to assist clients with their claim, even in the fixed costs world where we largely operate.

And, having crossed that floor, I acknowledge and in some ways admire the insurers’ focus on delivering decent yields to their shareholders in an era where investment returns have been shredded.

Furthermore, progress has been made by many insurers in balancing financial performance with commendable efforts to improve their reputation among their own customers and the general public.

Examples include Aviva’s diversity programme, or Axa CEO Amanda Blanc’s long held commitment to sales transparency and commission disclosure. More recently, Kenny Leitch, global telematics director for RSA, and his team have used telematics technology to bring down the cost of car insurance for young drivers and reduce accidents too. I also highlight the excellent work carried out by Ant Gould, director of faculties at the Chartered Insurance Institute, and the CII’s underwriting faculty to urge a renewed focus on the insurance needs of vulnerable people.

But collectively, as an insurance industry, why do so many own goals continue to be scored? Nowhere was this more exemplified than by the Association of British Insurers and its response to the government’s discount rate decision.

If the ABI’s role is to alienate the public, then it is doing a fine job. The decision was described as “crazy, up to 36 million individual and business motor insurance policies could be affected in order to over-compensate a few thousand claimants a year”.

Over-compensate a few thousand claimants? These people are not lobby fodder. They are catastrophically injured people, often youngsters, often paralysed, often needing 24-hour care for the rest of their lives. We pay our compulsory insurance to protect ourselves financially against just such a life-changing injury, and, incidentally, such insurance obviates the need for State provision.

The ABI went on to conflate the discount rate with the small claims limit, demanding that the Ministry of Justice fast-track the personal injury reforms, a controversial proposal that threatens to sweep away centuries-old tort laws, for a £40 saving that the ABI itself said to MPs would be unlikely to materialise.

Who is the ABI representing as it acts in so arrogant and high-handed a manner? Certainly not the millions of customers who buy motor insurance to protect themselves against life-changing injuries, or the many thousands of ordinary people who are injured through no fault of their own every year.

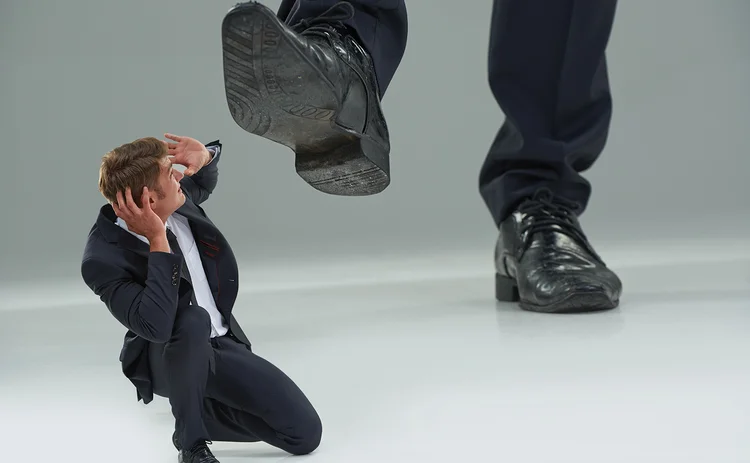

The ABI has itself admitted insurance has a trust problem, and also said that it was taking steps to deal with that problem. Really? If so, how does the foot-stamping and insults thrown at anyone who takes a different view fit into that trust-building strategy?

I urge those CEOs who fund the ABI and its PR machine that brooks no criticism to take a long, hard look in the mirror. Shamefully, some politicians swallow these bullying tactics, but customers who insurers have worked hard to win over certainly don’t.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@postonline.co.uk

Most read

- Covéa shrinks staff numbers by almost a third amid further losses

- Aviva CEO warns home insurance premiums need to go up

- DLG or Esure – which Peter Wood baby is most likely to bounce back?